The Student Loan Debt Crisis

One of the scariest parts of growing up in the American school system: The Student Loan Debt Crisis.

In 2020, student loan debts are through the roof. The national student loan debt totals around $1.6 trillion, exceeding car and credit card loans combined. We should all be concerned about this current problem now skyrocketing. It not only affects college students but also current highschool students. How do we plan to pay the immense amount of money college costs? We need to have a plan so we do not continue this problem of all students being deep in debt.

The first student loan to ever be given out was in 1840. However, student loan debt first started to skyrocket in the 1990’s. By 2019, everyone was familiar with the student loan debt crisis. College tuition has more than doubled since the 1980’s and more than 3 million senior citizens are still paying off their student debt. Student loan debt is the reason why 13% of Americans choose not to have kids. These mind-blowing facts more than backup the student loan debt crisis. This crisis is one that should not be ignored. Education is a must in the 21st century that everyone should be able to have access to.

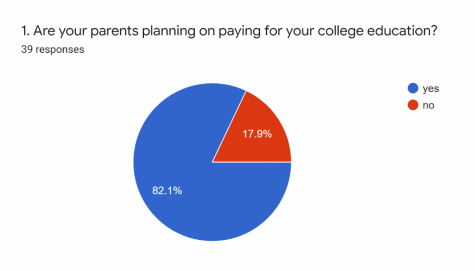

NAEye asked students how they were planning on paying for college and if their parents are planning on helping their kids out with college costs and received extraordinary responses.

About 80% of parents are going to help their children pay for college and only 20% are not. That means a large amount of students will not have to pay for school on their own which can be very beneficial in the long run. We also posed the question that if parents are going to help their children, how much will they be supporting them? Half of the responses say that parents will pay for more than 50% of their tuition and other funds. We even had responses that said their parents will pay for 100% of their college funds.

Supposedly, the loan debt crisis in the United States could continue to affect people who have already paid and are still paying for their college education but now they are going back to pay for their children’s education. The cycle is going to keep continuing and unless we make smart decisions about college and the money we are spending, we may never break the cycle.

We also asked teachers about how the student loan debt crisis is affecting them first being Mrs. Watt. She said that she is still has student loan debt, but that her parents helped pay for college similar to 80% of parents are going to help their kids here.

Even though college may be a few years away for some of us, we still need to start the preparation. Many of us already have jobs and our parents may already be saving away money for college for us. Students have debit and credit cards to practice how to spend money responsibly.

No matter what, we, as educated, young students, need to have a plan for college and how we are going to pay for it. It can be a devastating thing for future college students to have this unending debt keep rising. We have to have a plan for college and how we are going to tackle the high cost of college. Goal setting and financial planning can set up a future nicely and if we are prepared, we can break the loan debt crisis.

Madyson Cieszynski is a sophomore and this is her first year on the NAEye staff. She is a member of Key Club and the choir. Outside of school, she has...

Nicole Baker is a sophomore at NAI. This is her first year writing for the NAEye. Nicole enjoys musical theater. She has taken classes at Pittsburgh Musical...